We actively support our clients in the preparation and submission of GRESB assessments, adeptly capturing the full spectrum of ESG performance in real estate funds and companies.

GRESB Real Estate

GRESB Real Estate Assessment

The GRESB Real Estate Assessment provides a comprehensive ESG framework and benchmark for the real estate sector. It is widely recognized as the global standard for evaluating sustainability performance in real estate. The Assessment covers seven key aspects of ESG performance, including management, policy and disclosure, risk management, monitoring and environmental management systems, stakeholder engagement, social performance, and governance.

KEY BENEFITS

Participation in GRESB Assessments can help asset managers to demonstrate their commitment to sustainability and responsible investment, enhance their reputation and credibility, and better understand the expectations and priorities of their investors with respect to ESG issues. GRESB data and benchmarks can also inform strategic decision-making and help companies to prioritize actions to improve their ESG performance.

Our Services

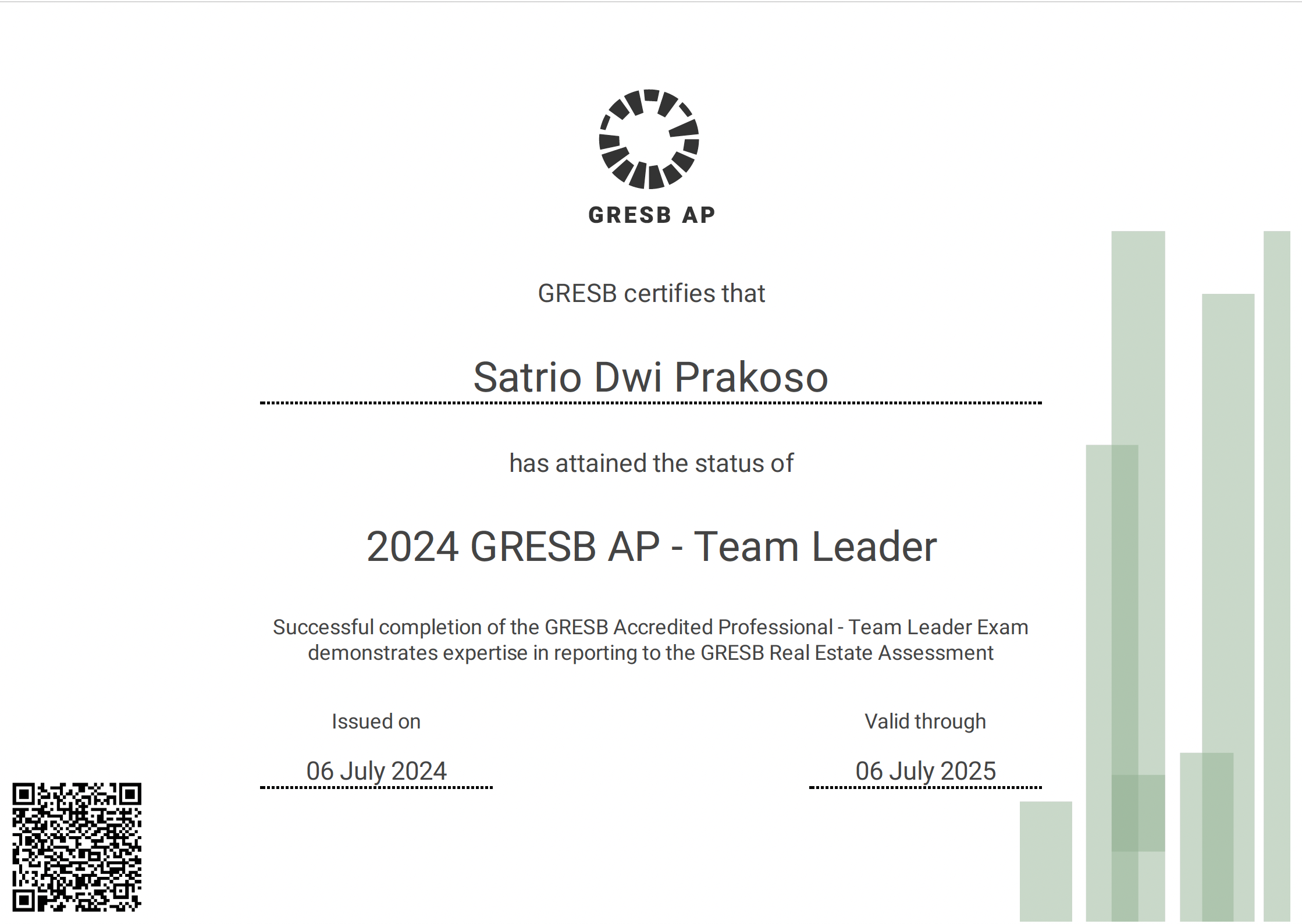

Our Founder and Principal Consultant, Satrio Prakoso, is a GRESB Accredited Professional (GRESB AP) working with real estate asset management to submit GRESB Real Estate for the past four (4) years. He can identify, analyze, and improve GRESB results from 3 stars to 5 stars, increasing the points from 82 to 95, both for Standing Investment and Development. Contact us to learn more about how we can help you to achieve maximum GRESB scores.